Introduction

In the realm of personal finance and real estate, few factors have a more profound impact on homeowners and potential buyers than mortgage interest rates. These rates dictate the cost of borrowing money to purchase a home, and their fluctuations can significantly affect one’s financial decisions. One of the key drivers of these fluctuations is inflation. In this blog post, we’ll delve into the intricate relationship between inflation and mortgage interest rates, exploring how changes in inflation can ripple through the housing market and shape borrowing costs.

Understanding the Basics

Before diving into the relationship between inflation and mortgage interest rates, let’s establish a foundational understanding of both concepts.

Inflation: Inflation refers to the general increase in the price levels of goods and services in an economy over time. When inflation occurs, the purchasing power of money decreases, meaning that the same amount of money buys fewer goods and services than before.

Mortgage Interest Rates: Mortgage interest rates is set by banks and lenders for loans to homebuyers. These rates determine the amount of interest that borrowers pay on their mortgage loans.

The Connection: Cause and Effect

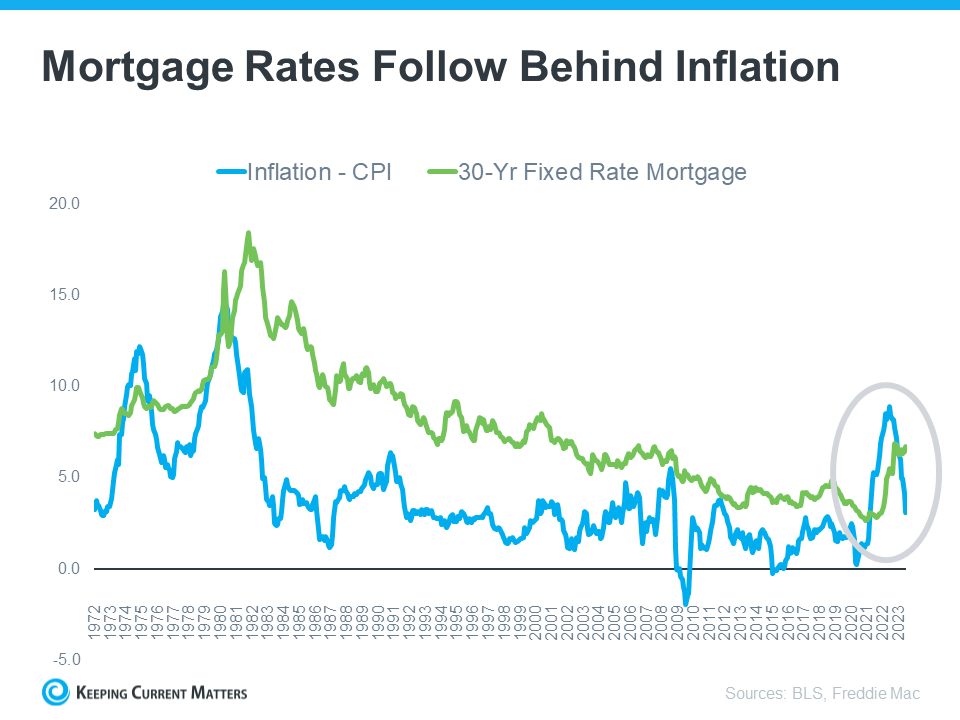

At first glance, the connection between inflation and mortgage interest rates might not be immediately apparent. However, a closer examination reveals a cause-and-effect relationship that can be summarized as follows:

High Inflation → Higher Mortgage Interest Rates Low Inflation → Lower Mortgage Interest Rates

Let’s delve into the reasons behind this correlation.

1. Central Bank Monetary Policy: Central banks, such as the Federal Reserve in the United States, play a pivotal role in managing inflation. They do this by adjusting interest rates and employing various monetary policy tools. When inflation rises, central banks might raise their benchmark interest rates to curb spending and borrowing, which helps control inflation. This increase in benchmark rates then cascades to other interest rates in the economy, including mortgage rates.

2. Bond Market Dynamics: Mortgage rates are influenced by the bond market, particularly the yields on government bonds. During times of high inflation, investors demand higher yields on bonds to compensate for the eroding effect of inflation on their returns. This translates to higher interest rates in general, including mortgage rates.

3. Lender Risk Assessment: Lenders take inflation into account when determining the risk associated with lending money. Higher inflation can erode the value of future loan repayments, making lenders wary. To offset this risk, lenders may increase mortgage interest rates.

Impact on Homebuyers and Real Estate

The connection between inflation and mortgage interest rates has a direct impact on the real estate market and potential homebuyers.

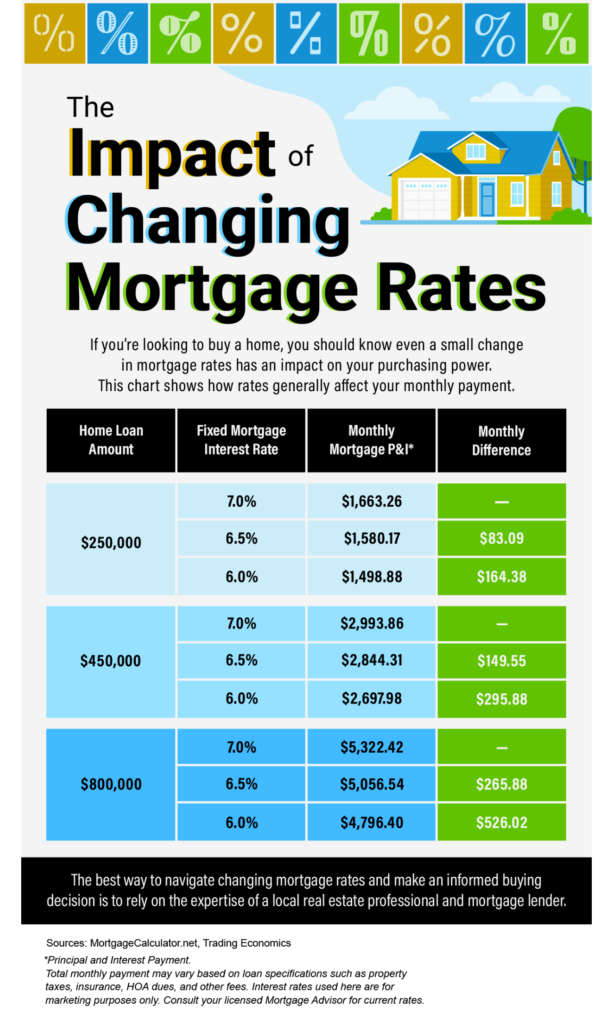

1. Affordability: When mortgage rates rise due to inflation, the cost of borrowing increases. This can reduce the purchasing power of potential homebuyers, potentially leading to a decrease in demand for homes. Conversely, lower mortgage rates during periods of low inflation can make homeownership more accessible.

2. Housing Market Dynamics: Fluctuations in mortgage interest rates influence demand for housing. High rates may slow down the market, while low rates can stimulate buying activity. This can affect home prices and the overall health of the real estate market.

3. Refinancing Activity: Homeowners often consider refinancing their mortgages when rates drop. Lower rates resulting from low inflation can lead to increased refinancing activity, giving homeowners the opportunity to reduce their monthly payments.

Conclusion

In the intricate dance between inflation and mortgage interest rates, it becomes clear that these two factors are intertwined in ways that significantly impact the housing market and borrowers’ financial decisions. As inflation rises and falls, the resulting changes in mortgage rates have far-reaching effects on affordability, demand, and the overall landscape of the real estate market. For prospective homebuyers and homeowners alike, understanding this relationship can empower better financial planning and decision-making in the dynamic world of real estate.